Technology Associates Kenya proud to implement Payments network with a suite of first-in-Africa services, at Africa’s leading Microfinance Bank.

Equity bank started its operation in 1984 as Equity Building Society. Their initial focus was to offer mortgage services but in the early 1990’s Equity Building Society changed its focus to micro-finance services. The growth in business volume and outreach necessitated the conversion to a commercial bank, a license they acquired on the 31st December 2004. The United Nations honoured Equity bank for its role in enabling the low-income rural population access loans. Equity was also voted by the World Bank as one of the best micro-finance institutions in sub-Saharan Africa. Equity bank started its operation in 1984 as Equity Building Society. Their initial focus was to offer mortgage services but in the early 1990’s Equity Building Society changed its focus to micro-finance services. The growth in business volume and outreach necessitated the conversion to a commercial bank, a license they acquired on the 31st December 2004. The United Nations honoured Equity bank for its role in enabling the low-income rural population access loans. Equity was also voted by the World Bank as one of the best micro-finance institutions in sub-Saharan Africa.

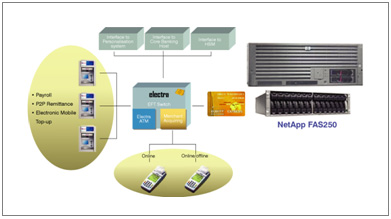

In an unprecedented initiative, Equity Bank contracted Technology Associates Kenya to deploy a country-wide EFT network of 50 ATMs and a number of POS terminals driven through the Electra EFT Switch.

The functionality offered through the self service ATM network at Equity Bank will include a range of yet un-offered services to the sub-Sahara Africa region. These include online, instantaneous country-wide Person2Person Remittance services, Mobile top-up and Payroll processing services, besides the regular host of cash and account-based, self-service ATM & POS services. The functionality offered through the self service ATM network at Equity Bank will include a range of yet un-offered services to the sub-Sahara Africa region. These include online, instantaneous country-wide Person2Person Remittance services, Mobile top-up and Payroll processing services, besides the regular host of cash and account-based, self-service ATM & POS services.

Under this project, Technology Associates Kenya won the turn-key project for the implementation of the EFT infrastructure including HP’s largest then installation in Kenya, of their rx 4600, 4 way Itanium2 processor server. The Storage system is the NetApp FAS 250 fibre channel unified storage solution, that offers maximum scalability and data replication capabiliies with simple upgrades. This high-availability Storage platform offers upto 1.0 terrabyte storage capacity. The switch will reside off HPUX 11i and Oracle 10g.

The Server will form the basis of the bank’s EquiSwitch EFT solution offering services to their close on 500,000 customers across 30 branches, the Equity Express card based payment services. The Server will form the basis of the bank’s EquiSwitch EFT solution offering services to their close on 500,000 customers across 30 branches, the Equity Express card based payment services.

|